By Rawan Elhalaby,

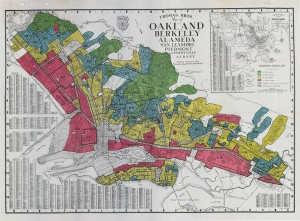

Once again, the Trump administration is advancing an agenda that favors banks to the detriment of communities of color. Office of the Comptroller of the Currency head Joseph Otting proposes to gut the Community Reinvestment Act — an over 40-year-old law created to fight redlining. The CRA requires banks to make investments in low-income neighborhoods through actions like making accessible home loans, having branches in low-income neighborhoods, and supporting small businesses in an attempt to make up for decades of race-based disinvestment.

Under the direction of Otting, a former banker and current friend to banks, the OCC has released an Advanced Notice of Proposed Rulemaking that essentially proposes to weaken the legislation and lessen its impact on communities that still carry the burden of redlining. Recent investigations by Reveal show that redlining never completely went away, and these historically underserved areas continue to fall behind in racial and economic equity indicators. We know a lot about why this is happening: Financial institutions continue closing branches at a rapid rate, home lending to low-income borrowers and people of color lags behind their share of the population, small businesses in these communities struggle to access affordable capital, and few resources are being put towards affordable housing development.

Like many laws, the CRA could be improved — something that’s been tried unsuccessfully a few times. The law is vague and lacks specific requirements, banks often view it as a regulatory burden, and with the rise of online banking and FinTech, many view the CRA as outdated.

But most important, this critical anti-redlining law has no racial lens. You simply cannot adequately remedy decades of race-based disinvestment without using race-based criteria. And right now, banks are not held accountable for making investments in people of color and are not penalized for engaging in activities that harm communities of color, like funding displacement and gentrification.

How is the OCC suggesting to update the CRA?

The OCC wants to redefine what counts towards a bank’s CRA credit, while another suggestion recommends expanding where banks should be making investments to low-income individuals. Expanding the definition of CRA investments will give banks credit for services they already provide and in regions that are easier for them to serve. Rather than making investments in particularly underserved communities–communities that some banks and commentators falsely brand as inherently risky–banks will be given a free pass to focus on activities that give them the “most bang for their buck.” This proposal will give banks CRA credit for home loans to wealthy home buyers in low-income neighborhoods and de-incentivize them from making home loans to borrowers with less established credit histories.

Another suggestion is to simplify the CRA exam by grading banks using a single metric: a ratio of a bank’s community investments divided by the bank’s investments. Instead of thoughtfully considering how a bank’s CRA activities meet the needs of the local community, this suggested metric will lump all of a bank’s CRA activity together and rob communities of investments where they actually need them. This “one size fits all” approach might end up benefiting no one.

We need community engagement for effective CRA reform

The Advanced Notice of Proposed Rulemaking asks consumers, banks, and community advocates to weigh in on the proposed changes to the CRA by writing letters to the OCC. This process to reform the CRA, as initiated by only one federal regulatory agency, undermines both other regulatory agencies and the community. Still, this is our opportunity to help build a stronger, more effective CRA and resist changes that would dilute it by responding to these proposed changes. Join the Greenlining Institute in writing to Joseph Otting and saying that we need a stronger CRA that keeps bank’s accountable to the communities of color this law was intended to support. Submit comments to the Federal Register by November 19 to have your voice heard.

Rawan Elhalaby is Greenlining’s Economic Equity Manager. Follow her on Twitter.